Natural gas prices are at $2.28/MMBtu today. They spent a couple good weeks up at about $2.50/MMBtu. It seems that we stored more gas than expected.

The third largest storage facility in North America (in Alberta, Canada) is at its lowest level in twenty years. That would typically drive prices up some, but it doesn’t seem to be doing so. Read the first of two articles about it over at RBN Energy.

Gas production is hitting new highs and setting new records. More interesting though are the last two paragraphs of the article which say that DUCs (Drilled but UnCompleted wells) have gone down a lot.

West Virginia’s DEP approved a coal-to-liquids plant that would combine natural gas and coal to create diesel, gasoline, and other fuels. It’s the first full sized coal-to-liquids plant in the United States. Importantly for West Virginia, it’s turning some of our natural gas into a more refined product, increasing its value before it’s sent out of state.

The US is producing more natural gas than it needs right now, and companies have been building facilities to ship it overseas. Unfortunately, it seems that “overseas” also has a lot of natural gas, and probably will for the near future. Thanks to horizontal fracking, the world of the near future is going to have plenty of natural gas. Good for consumers, not so good for your friendly neighborhood oil and gas attorney.

On that same line of thought, England uses a lot of American natural gas because they banned horizontal fracking a while back.

The attack on Saudi oil production affected their light crude the most. When the U.S. imposed a tariff on oil to China, that’s the same grade of oil that it affected. So now China is forced to buy U.S. oil with a tariff.

FERC has approved another LNG facility. It’s in Jacksonville, FL, and will send LNGs to the Caribbean. It’s kind of small compared to some of the others that have been built recently, but every little bit counts.

The oil and gas investment community has changed the way it thinks about price forecasting. The attacks on Saudi infrastructure have added an element of uncertainty to things. If Saudi infrastructure can be hit, anything else could be.

Trying to figure out how this oil and gas law business will do in the next couple years we’ve run across this handy page over at the Energy Information Agency. It says what we’ve been expecting, for the most part. It looks like natural gas prices are going to stay about the same for quite some time. We are unlikely to see prices above $3.00, or anything below $2.00 (at least for long). Production can outpace demand; the only thing slowing producers down will probably be a lack of capital. Hopefully we don’t have a new crop of investment bankers come in and decide they can make money in oil and gas because when oil and gas companies get money they drill and produce, driving supply up and prices down.

The National Review makes the argument that we can have either more fracking or more war.

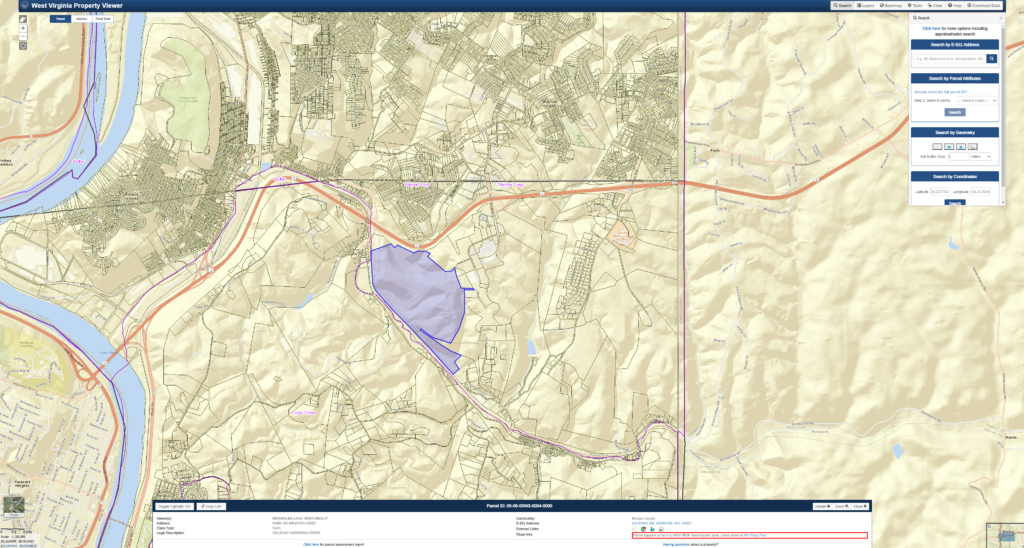

West Virginia benefits from the taxes paid by natural gas producers. WVONGA put together a report showing how much property tax (not severance tax) was paid just by natural gas producers this year.

Some people would like to build an NGL storage facility on the Ohio River. The NETL has created a report supporting it.

India’s gas company, Petronet, has agreed in principle to invest $7.5 billion into Tellurian’s Driftwood LNG terminal in Louisiana. India plans to get 5 MM tons of LNG per year from the plant.

IHS Markit is predicting an average natural gas price below $2.00/MMBtu next year.

West Virginia is the seventh largest producer of natural gas in the US. This Rigzone article goes into some detail about what that means.

Here’s a news report including video footage of the new cracker plant going up in PA.

Japan is going to invest $10 billion into diversifying the source of its LNG. Presumably this means it will take more from the US.

Antero Resources puts a good chunk of change into upgrading and maintaining the small country roads it uses. Even so, there are places they’re not getting to. Good on ya, but lets get the rest taken care of, too.

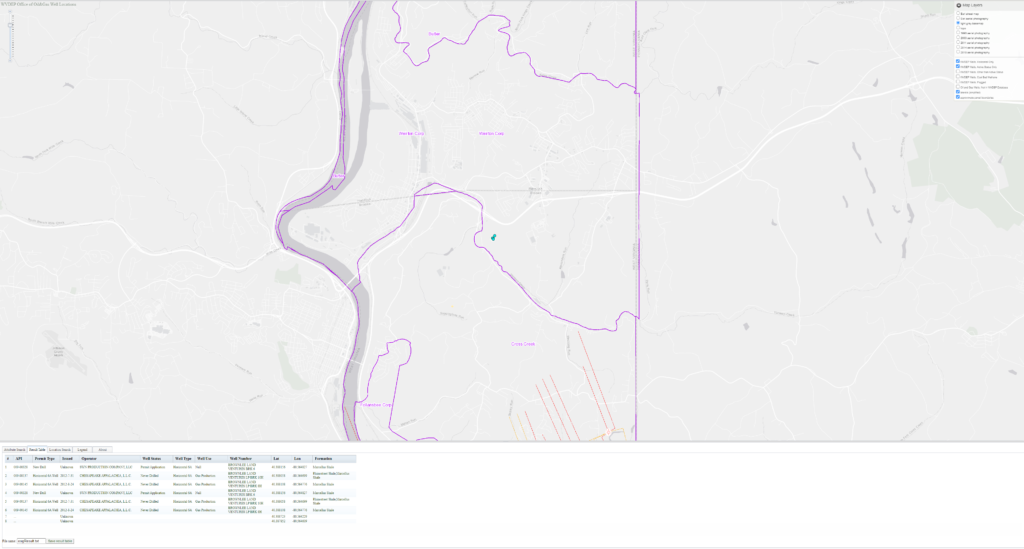

Antero’s water treatment facility in Doddridge County has been closed. It seems low gas prices have made it a financial burden on the company.

And there’s yet another LNG plant being built in Louisiana. That makes three for anybody who’s not counting.