The biggest problem for gas developers, and consequently royalty owners, here in West Virginia has been the lack of pipeline infrastructure to transport the gas to market. The Marcellus shale development has been so fast that it was impossible for pipeline companies to keep up. Either that or they just didn’t think ahead far enough. Either way, midway through 2015 we need pipelines in a bad way. Hope is on the horizon, however.

This article over at SeekingAlpha is practically a list of pipelines and completion dates. Conspicuously absent are the Mountain Valley Pipeline and the Atlantic Coast Pipeline, but those won’t even start construction until next year.

The article points out that pipelines are about to start coming online, and that will drive the cost of transportation down. As the cost of transportation goes down, the profit to producers is going to go up.

West Virginia mineral owners can expect to see an uptick in production, so their royalty checks should get bigger. Those who aren’t leased can expect to see leasing start back up, too.

The next few years will see increased transportation capacity, so mineral ownership should only get better and better from here on out.

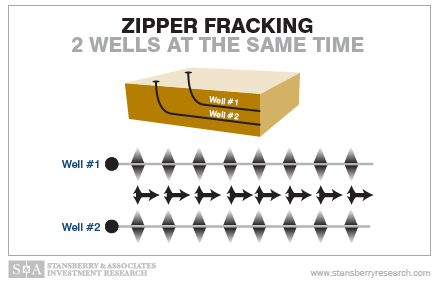

We’re not sure how this happens, but a new pipeline at a drilling site in Tyler County, West Virginia,

We’re not sure how this happens, but a new pipeline at a drilling site in Tyler County, West Virginia,