There’s a new study out by the Southern Environmental Law Center that says the economic impact of the Atlantic Coast Pipeline will not be as great as Dominion’s study indicated it would be. SELC’s study points to a variety of flaws and assumptions used in Dominion’s study. You can read the report in it’s entirety here.

There’s a new study out by the Southern Environmental Law Center that says the economic impact of the Atlantic Coast Pipeline will not be as great as Dominion’s study indicated it would be. SELC’s study points to a variety of flaws and assumptions used in Dominion’s study. You can read the report in it’s entirety here.

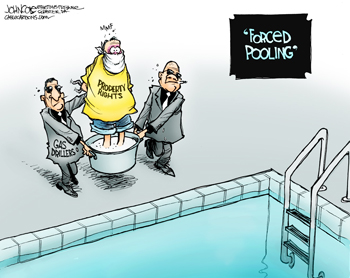

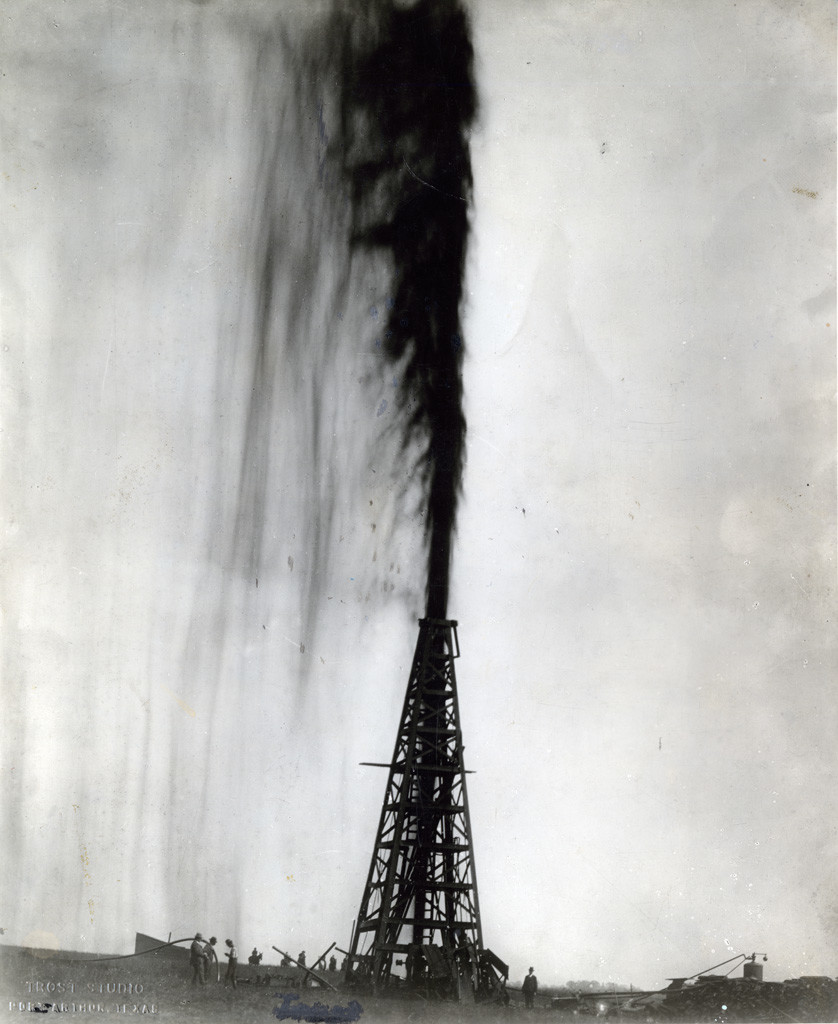

Both studies look at the overall impact of the pipeline, not just to localized areas. We think that the ACP will have an enormous economic impact in West Virginia. There simply isn’t enough pipeline capacity to carry away all the natural gas that West Virginia is capable of producing. Gas producers are paying $1.00 per MCF to transport their gas. When gas prices are under $3.00 per MCF, that’s a pretty substantial amount of money. Producers have to make money at under $2.00 per MCF. Their profit margins at those prices are awfully thin. Adding pipeline capacity will cut the price of transportation some. When they’re making more money, gas producers will take more leases and drill more wells. That’s good for West Virginia property and mineral owners.

Whether the ACP will have a huge economic impact or a slightly less huge economic impact is not extremely important for West Virginia royalty and mineral owners. The ACP will reduce the cost to transport gas and increase the amount of gas produced. If we’re smart about it, we can make sure some of the resulting profits end up in the hands of West Virginia surface owners on the pipeline route, and in the hands of West Virginia mineral owners in the production area.

We’re waiting for landmen to start making offers on the pipeline route. When they do we’ll be helping property owners negotiate the best possible deal for their surface rights and helping them get protections for the rest of their property. Give us a call when the landman comes knocking. We can hardly wait to start negotiating with them.