EQT has announced that it will start drilling Upper Devonian formations along with the Marcellus shale. This is a great move, and while I don’t like EQTs stance on post-production costs or know anybody that really likes working with them, I have to applaud it. Here’s why.

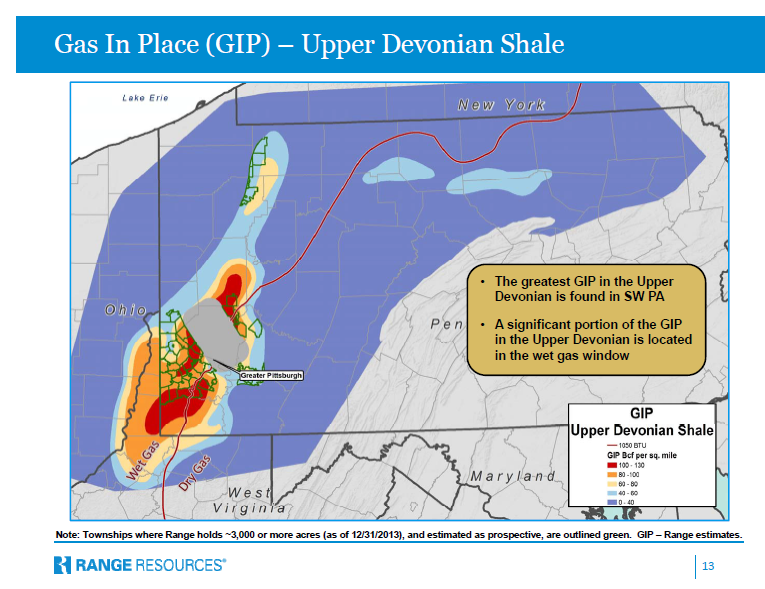

The Upper Devonian lies just a few hundred feet above the Marcellus shale. It produces gas, sometimes wet gas that is rich in ethane, propane, butane and the like. It doesn’t produce as much gas as the Marcellus, though, so a lot of companies have ignored it.

If memory serves, you can improve production from any acre by about 50% if you can produce from both the Marcellus and the Upper Devonian.

However, if you develop the Marcellus without developing the Upper Devonian formations you are unlikely to be able to develop the Upper Devonian. This is because the fractures you make in the Marcellus migrate upwards for hundreds of feet, right up to the Upper Devonian formations. When you go back later to fracture the Upper Devonian you lose a lot of, if not all of, your fracking pressure into the existing fractures.

In order to take advantage of the Upper Devonian formations you have to frack them at the same time you do the Marcellus formations.

Anybody out there negotiating their own lease should ask the company whether they are planning to develop the Upper Devonian, and find out why they are not. They may have good reasons, such as it simply won’t produce much gas in your area.

You probably won’t be able to convince them to change their plans unless you control all of hundreds of acres, but you could always tell them you won’t sign a lease unless there’s something in there saying they will develop the Devonian with the Marcellus. It’s worth a shot.