Most of the people we talk to had no idea they owned oil and gas rights in West Virginia until a landman contacted them asking for a lease or until an investment company contacted them asking to buy their rights. Lots of people consider selling their mineral rights, even if they haven’t been approached by an investment company.

When we discuss whether to sell with our clients we talk about a few things. They mainly boil down to “will the money now be better for me than the money later?”.

Part of that discussion includes determining how much money could be coming down the road. Most people think about what they could get for a signing bonus if a company buys a lease from them, and what the royalties could be.

Sadly, it’s impossible to say for sure what the royalties could be. Anybody who tries to give you an exact figure is either lying or uninformed because the price of gas, the amount of production, and your actual ownership amount can’t or won’t be determined until gas is actually flowing out of the well and being sold.

That said, we do try to guess what that number could be over time, and part of that guessing includes which formations might be producible in the future.

Most people know about the Marcellus and the Utica formations, and in the areas that are being heavily developed right now both formations are likely to be developed.

Most people don’t know about the work that Cunningham Energy has been doing on shallower oil-bearing formations.

Cunningham Energy began work on two wells in Clay County, WV back at the end of 2014. Online sources don’t report any production from the wells, probably because they are considered exploratory and so aren’t required to report their numbers to the State. However, this newspaper article says those wells have reached a cumulative 20,000 barrels of production. Cunningham also reported that kind of production from some other Clay County wells in June of 2015.

It’s hard to say for sure whether that’s worth getting excited about. If these new wells were put into production in the middle of 2015, they’ve been producing for two years and paid out about $1,000,000 assuming an average of $50/bbl (which is generous). It’s new technology, fracking a formation for the first time, and getting the combination of fluid additives, pressure, and techniques right could significantly enhance the amount of oil that is produced in the future, so there’s hope that this could be very lucrative.

However, the important data for the purpose of this post is that there’s another formation which could produce royalties for you.

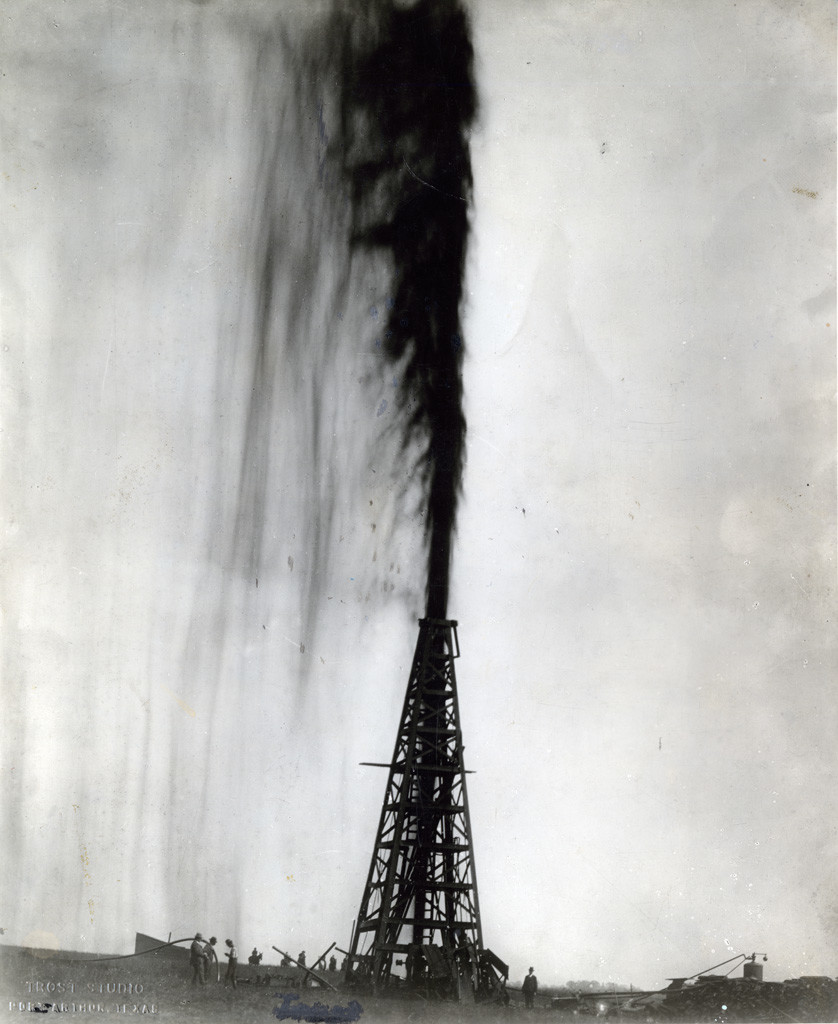

And there could be others. Horizontal fracking is in its infancy. There were a lot of formations in West Virginia that produced oil back in the late 1800s and early 1900s. The combination could result in tens of thousands to hundreds of thousands of dollars in royalty money from any given acre of mineral rights in West Virginia.

When you’re thinking about selling or keeping your minerals, make sure that you get all the data necessary to make the right decision. We’re not telling you that it makes sense for you to always keep your minerals or always sell your minerals, but that you need to talk with someone who can help you think it through so that you make the decision in a way that will allow you to sleep at night. We can help you do that.